Electronic Fund Transfer How Does It Work

The transaction information should. You contact your bank or non-banking money transfer company.

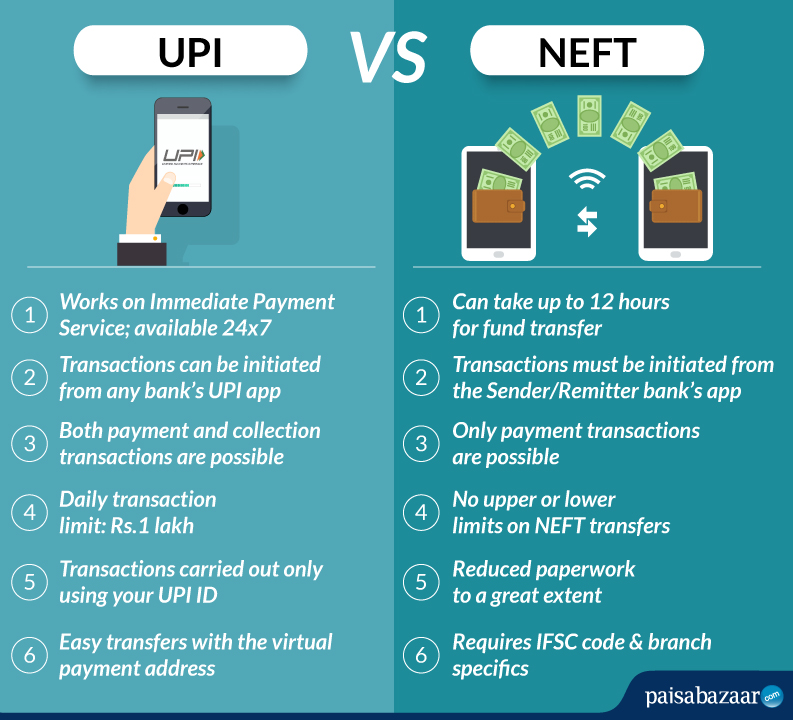

Upi Vs Neft What Are The Benefits Of Upi

To initiate a one-time electronic fund transfer from a consumers account.

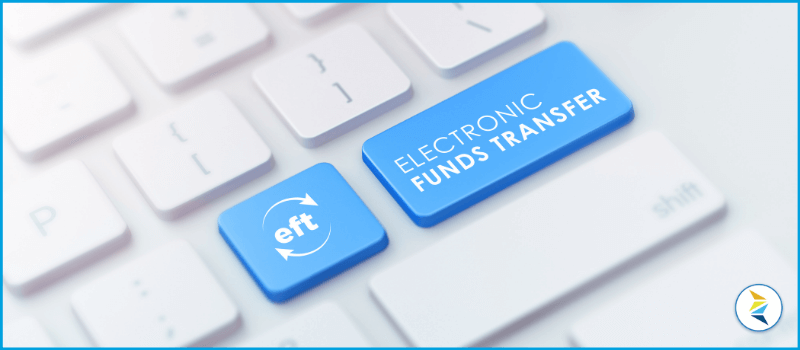

Electronic fund transfer how does it work. You probably use EFT all the time -- its simply a completely electronic way of transferring money from one bank account to another bank account. Electronic Funds Transfer Process When you use your card at a store money is electronically transferred from your account and then it is simultaneously deposited in the store account. Its as simple as using a paper check and best of all its totally free.

On the accounts of its employees clients suppliers etc to their Financial Institution. What is EFT and how does it work. EFTs require both the sender and recipient to have bank accounts.

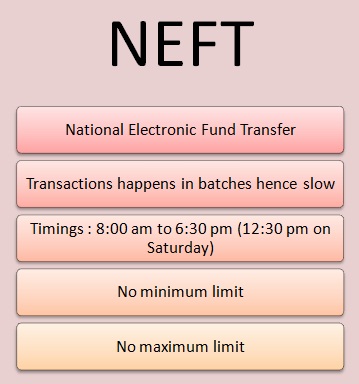

There are a variety of different kinds of EFT all of which operate on the same principle of moving money from one account to another. NEFT-NATIONAL ELECTRONIC FUNDS TRANSFER The National Electronic Funds Transfer is a nation- wide money transfer system which allows customers with the facility to electronically transfer funds from their respective bank accounts to any other account of the same bank or of any other bank network Funds transfer through NEFT requires a transferring bank. When an individual or institution initiates an electronic funds transfer signals are sent from the terminal via 128-bit encryption.

Online money transfer is where the old-fashioned concept of wiring money converges with the modern technology of electronic funds transfer or EFT. Either the consumer or the bank can initiate an electronic transfer. A banks customer will send a list of transactions to be made eg.

To process an electronic payment several players are involved including WorldlineFirstly theres of course your bank. The transaction is done electronically over a computerized network. What is an Electronic Funds Transfer Definition Process Benefits Video Lesson.

The consumer must authorize the transfer 12 CFR 10053b2 Electronic fund transfer EFT is a transfer of funds initiated through an electronic terminal telephone computer including online banking or magnetic tape for the purpose of ordering instruct-. You need to pay for your transfer and provide the recipients bank account details including a SWIFT or. Electronic Transfer is a safe and secure electronic funds transfer EFT process which allows you to deposit and withdrawal through your bank account Canadian personal checking accountsonly.

What is an Electronic Funds Transfer Definition Process Benefits Video Lesson Transcript - YouTube. The accounts do not have to be at the same financial institution to transfer funds. The accounts can be at the same financial institution or two different financial institutions.

These payments move between people and banks to. The maximum limit for a single transaction under EFT has been enhanced to Rs. What is electronic funds transfer.

An electronic funds transfer moves money from one account to another electronically over a computerized network. This happens either within the same banktransfer provider or across different institutions and within either the same country or between different countries. How do wire transfers work.

An electronic fund transfer moves money from one account to another. WORKING OF ELECTRONIC FUND TRANSFER The EFT enables transfer of funds within the city or cities and between branches of a bank and across banks. An electronic funds transfer moves money from one account to another electronically over a computerized network.

An electronic banking transaction -- also called an electronic funds transfer EFT -- is any transaction that is processed over the Internet. The accounts do not have to be at the same financial institution to transfer funds. EFTs require both the sender and recipient to have bank accounts.

How does an electronic funds transfer work. Electronic Funds Transfer is an authorized transmission of funds from or to accounts through the Automated Clearing House. EFT transactions are also referred to as electronic banking.

Simply stated electronic funds transfer payments are payments completed over a computer network. Both individuals and businesses can make EFT payments over the computer using. How Do Electronic Funds Transfers Work.

But other players are important too. What information do I need to provide to use Electronic Transfer. Paper money is not.

This is a highly secure method of securing sensitive data through the internet to the receiving unit. A domestic wire transfer or bank transfer refers to an electronic funds transfer method that is used by banks and other financial institutions. Heres how it works.

Rtgs Vs Neft Difference Between Neft Rtgs Limit Transfer Timing Snapshot

What Is Electronic Funds Transfer Eft How It Works With Netsuite Erp 3 Min Explainer Youtube

:max_bytes(150000):strip_icc()/ElectronicFundTransferAdobeStock_91053116-912781d9ce5b406192b7704d0bd1e91f.jpeg)

How The Swift System Works Swift Transactions

Electronic Fund Transfer Act Consumer Rights Protections

Imps Immediate Payment Service Instant Fund Transfer Npci

Moving Your Money Electronic Funds Transfer Forbes Advisor

Eft Payments The Ultimate Guide

17 Advantages And Disadvantages Of An Electronic Funds Transfer Vittana Org

What Is Electronic Funds Transfer Eft Payments Explained Ebanx

Ach Vs Wire Transfer Comparison Faqs Avidxchange

Everything You Need To Know About Eft Payments Remitr

Instant Transfers Banco De Portugal

Neft What Is Neft Neft Timings Neft Transfer Daily Limits

National Electronic Funds Transfer Neft Banking Study Material Notes

Eft Payments The Ultimate Guide

What Is An Eft Electronic Funds Transfer Eassist Dental Billing

Eft Payments The Ultimate Guide

/what-does-ach-stand-for-315226_FINAL-a68079317cfb403aaa73cab72e1762ab.png)

Post a Comment for "Electronic Fund Transfer How Does It Work"