Electronic Funds Transfer Risks

Examination Modules October 2000 Electronic Funds Transfer Risk Assessment Page. Some transactions that use this method are particularly risky such as wiring money to an office that pays proceeds in cash.

Eft Payments The Ultimate Guide

EFT has become a predominant method of money transfer since it is a simple accessible and direct method of payment or transfer of funds.

Electronic funds transfer risks. Automated Clearing House Electronic Funds Transfer - covers loss to the bank arising from the debiting or crediting of a customers account on the faith of any fraudulent electronic funds transfer instructions received by the insured bank from an electronic fund transfer system of an automated clearing house eg FEDWIRE BANKWIRE CHIPS and SWIFT and purporting to have originated. Electronic Funds Transfer user In 2020 e-commerce in South Africa spiked by 66 driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales. As a digital transaction there is no need for paper documents.

In the US an estimated 500 billion is transferred among financial institutions daily. All in all EFT transactions are far safer than writing paper checks. One participants failure to settle could deprive other participants of the funds they need to settle systemic risk.

Download Citation RISKS EVALUATION IN ELECTRONIC FUNDS TRANSFER The paper examined the numerous frauds that banks have sustained over the years in offering funds. ABSTRACTElectronic Data Interchange is the most prevalent method that financial institutions use to transfer funds. Unless you initiate an electronic funds transfer to pay yourself or transfer money between accounts there is no way to verify that the intended recipient got the cash.

Electronic Data Interchange is the most prevalent method that financial institutions use to transfer funds. In the US an estimated 500 billion is transferred among financial institutions daily. First the criminal acquires the logon credentials of a legitimate funds transfer system user.

The statement went on to detail some of these risks such as the potential for fraud and financial crime as well as data privacy issues. 03092001 Standards Associated Risks. Legitimate users visit ordinary-looking websites that plant malicious software on their computers.

While affording convenience and speed Electronic Funds Transfer EFT also involves potentially serious security problems requiring financial institutions to take special precautions in. One of the big four banks recently noted that there are also significant risks for the businesses themselves that sign over their banking and client information to a third party. Furthermore both law enforcement.

While there are some dangers that giv-ing these problems higher visibility through public discussion may at first make them worse the public is entitled to know what risks they are exposed to in using EFT serv-ices. So how can South African consumers and businesses continue to use instant EFT in a. Security refers to the protection of the integrity of EFT systems and their information from illegal or unauthorized access and use.

After the 60-day mark consumers risk losing all the money involved in the fraudulent transfer. Or legitimate users may open innocent-looking email attachments that infect their computers with malicious software. Examination Modules 1020 ELECTRONIC FUNDS TRANSFER RISK ASSESSMENT.

Transferring funds electronically ensures greater security and protection Most EFTs use an ACH as intermediary providing an additional layer of security Recurring EFTs can be set up to send money on a regular basis There is no need to handle and deliver physical documents or cash. Generally procedures used in the Expanded Analysis should target concerns identified in the Core Analysis Procedures and Core Analysis Decision Factors. An electronic funds transfer EFT or direct deposit is a digital movement of money from one bank account to another.

Privacy Security and Equity conventional thefts from financial institu-tions. Selected ElectronicFunds Transfer Issues. This increase was accompanied by an upsurge in the use of instant Electronic Funds Transfer EFT payments.

Electronic Funds Transfer Risk Assessment Examination Start Date. Security risk arises on account of unauthorized access to a banks critical information stores like accounting system risk. The flexible guidelines specified for the Core.

Someone with a fake ID could collect the money without going through an extensive verification process. This typically happens two ways. Avoiding Instant Electronic Funds Transfer payments Risks July 15 2021 by Africa Business In 2020 e-commerce in South Africa spiked by 66 driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales i.

When you pay by check you make it possible for anyone who happens to see your check to obtain your bank account and routing numbers. Electronic Funds Transfer EFT have an opportunity to observe such things not all inclusive as suspicious activity loan participation activity borrowing activity brokered deposits and. There are a plethora of risks and issues which are associated with EFT which in other words have proved to be disadvantages of electronic banking.

While affording convenience and speed Electronic Funds Transfer EFT also involves potentially serious security problems requiring financial institutions to take special precautions in Automated. Systems settlement fails liquidity risk. These transfers take place independently from bank employees.

What Is Electronic Funds Transfer Eft Payments Explained Ebanx

Rtgs Vs Neft Difference Between Neft Rtgs Limit Transfer Timing Snapshot

:max_bytes(150000):strip_icc()/ElectronicFundTransferAdobeStock_91053116-912781d9ce5b406192b7704d0bd1e91f.jpeg)

How The Swift System Works Swift Transactions

Eft Payments The Ultimate Guide

How To Transfer Money For A Closing

Moving Your Money Electronic Funds Transfer Forbes Advisor

Eft Payments The Ultimate Guide

17 Advantages And Disadvantages Of An Electronic Funds Transfer Vittana Org

/ATM-56a634a15f9b58b7d0e06764.jpg)

Electronic Fund Transfer Act Efta Definition

Electronic Fund Transfer Act Consumer Rights Protections

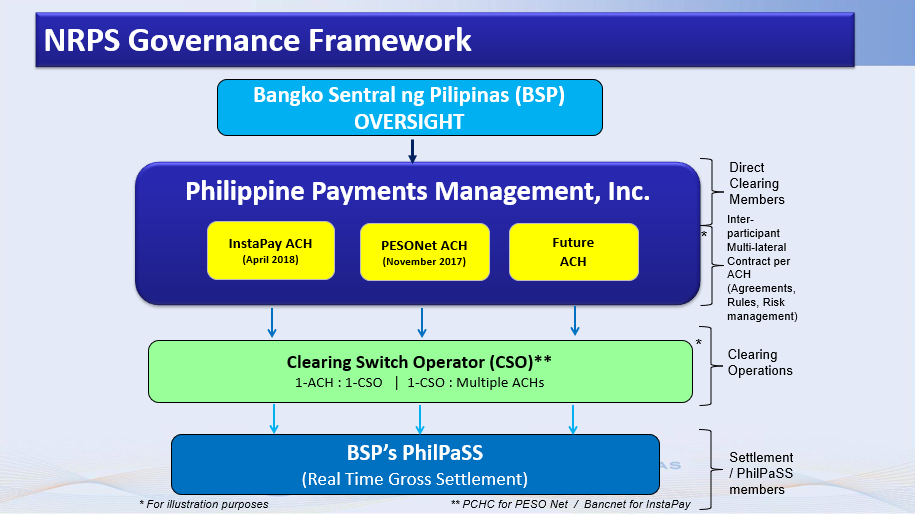

Payments And Settlements National Retail Payment System

Eft Payments The Guide To Electronic Fund Transfers Avidxchange

Electronic Funds Transfer Eft Bpay Or Cheque Revenuesa

Eft Payments The Ultimate Guide

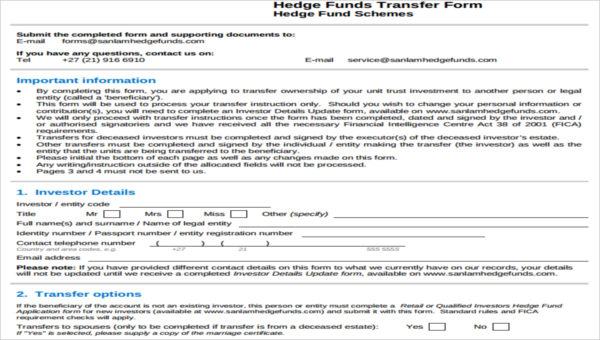

Free 9 Sample Fund Transfer Forms In Ms Word Pdf Excel

Ach Vs Wire Transfer Comparison Faqs Avidxchange

Neft What Is Neft Neft Timings Neft Transfer Daily Limits

Payment And Settlement Systems A Primer Vinod Kothari Consultants

Wire Transfer Vs Online Transfer Key Differentiators Remitr Blog

Post a Comment for "Electronic Funds Transfer Risks"