Electronic Equipment Depreciation Rate

Hand dryers electrical 10 years. The Widget has a useful life of 10 years.

Definitions Depreciation In Fixed Assets The Monetary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained

3930 b End user devices such as desktops laptops etc.

Electronic equipment depreciation rate. Garage and other work equipment. Depreciation rates as per IT Act for most commonly used assets Rates has been changed for financial year 2017-18 and onwards. Value of the asset 1000-200800.

For the first year. Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. Without depreciation Company A would show 100000 in expenses.

Company A buys a new piece of equipment the Widget for 100000. Some of the benefits of purchasing electronic equipment insurance EEI are. Before March 23 2004.

Billboard steel structures incorporating electrical systems footings scaffolding and walking platforms and steel frame sign panels 20 years. 6316 XIII Laboratory equipment NESD a General laboratory equipment. For the first year all you have to do is multiply the total cost of the computer by 20.

The computer will be depreciated at 33333 per year for 3 years 10003 years. Where NBV is cost less accumulated depreciation. Formula to calculate depreciation through double declining method is.

The depreciation expense for 2019 shall be 1020 according to the working. Lets consider the cost of equipment is 100000 and if its life value is 3 years and if its salvage value is 40000 the value of depreciation will be calculated as below. 3 iii Commercial vehicle which is procured by the assessee on or after October 1 1998 but before April 1 1999 and is used for any period of time prior to April 1 1999 for the purpose of profession or business in agreement with the third proviso to clause ii of sub-section 1 of section 32.

Consider this example. Depreciation 100000 40000 Book Value 60000 Value of Depreciation 600003 20000. Class 10 with a CCA rate of 30 includes general-purpose electronic data processing equipment commonly called computer hardware and systems software for that equipment including ancillary data processing equipment if you acquired them either.

The policy can also bear the additional costs of overtime night work and double pays on public holidays. For instance if you had an old laptop that the electronics store valued at 300 and put toward your 1500 new laptop you. After March 22 2004 and before 2005 and you made an election.

The opening NBV for 2019 would be 7300 8500 1200. Furniture and office equipment. Thus depreciating assets require a useful life estimate.

When you know the number of years your computer has been used you are ready to calculate the depreciation value. XI Office equipments NESD 5. Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

Hence the depreciation expense for 2018 was 8500-500 15 1200. Land and Support Assets. Commercial vehicle means heavy goods vehicle heavy passenger motor vehicle light motor vehicle medium goods vehicle and medium passenger motor vehicle but does not include maxi-cab motor-cab tractor and road-roller.

2589 b Laboratory equipments used in education institutions. By equipment category for period ending December 31 2018 Telecommunications plant category Depreciation rate. 4507 XII Computers and data processing units NESD a Servers and networks.

Depreciation rates are based on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives. Diminishing Value Rate Prime Cost Rate Date of Application. If the computer has a residual value in 3 years of 200 then depreciated would be calculated on the amount of value the laptop is expected to lose.

Environmental control equipment including condensers and associated equipment bio-filters air-scrubbers after-burners and dissolved air flotation systems 10 years. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. Not Book Value Scrap value Depreciation rate.

Now the maximum rate of depreciation is 40. Blood drying equipment includes blood holding tanks agitated holding tanks coagulators driers decanters and dried blood hoppers 10 years. The value that you will get is the depreciation value.

The complete cost of lossdamage to data or electronic equipment are covered irrespective of the depreciation cost of the equipment. How long an asset is considered to last its useful life determines the rate for deducting part of its cost each year. The IRS limits this sort of same-year depreciation benefit to items up to 1000000.

170 lignes Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. In addition if you traded in an old piece of electronic equipment to put towards the cost of your new one you may not deduct the trade-in amount from your one-year depreciated value amount.

Reel To Reel Tape Recorder Manufacturers Crown Audio Inc Museum Of Magnetic Sound Recording Crown Audio Tape Recorder Audio

Why Capital Depreciation Of It Equipment Is Challenging

11 1 Chapter 11 Depreciation Impairments And Depletion

11 1 Chapter 11 Depreciation Impairments And Depletion

4 Ways To Depreciate Equipment Wikihow

4 Ways To Depreciate Equipment Wikihow

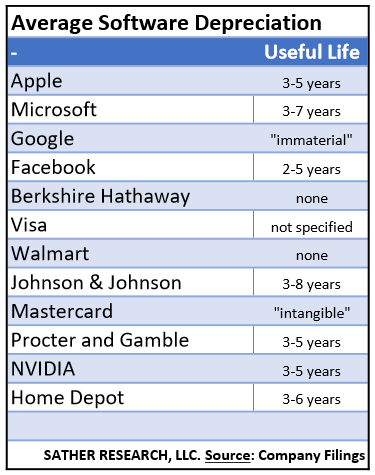

Accounting Rules Of Computer Software Depreciation For 2020 And Beyond

How To Calculate Depreciation Expense For Business

4 Ways To Depreciate Equipment Wikihow

Depreciation Rate Chart As Per Income Tax Act Finance Friend

How To Store Your Photographs And Video Affordable Cloud Storage Solution When Producing Photography An Storage System Photography And Videography Photography

Latest Depreciation Rates As Per Income Tax Act And Companies Act Faceless Compliance

Depreciation Rates As Per I T Act For Most Commonly Used Assets Taxadda

Consider The No Depreciation Cow Calf Operation Cow Calf Cow Calves

Sales Letter To Current Client In 2021 Sales Letter Business Letter Sample Letter Templates

Depreciation Rate For Furniture Plant Machinery Indiafilings

Depreciation Formula Calculate Depreciation Expense

A Guide To Depreciation Rates As Per Income Tax For Ay 2020 21

Tax Support For The Firms That Support Recycling Recycling Recycling Companies Electronic Recycling

Post a Comment for "Electronic Equipment Depreciation Rate"