Indonesia Electronic Transaction Tax Rate

Shares are traded on the Indonesia Stock Exchange IDX there is a further decrease in the corporate income tax rate of 3 so that its corporate income tax rate is 19 for fiscal years 2020 and 2021. For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller.

Pdf Land Price Mapping Of Jabodetabek Indonesia

Electronic transaction tax Where the Indonesian Tax Authority ITA is unable to determine the existence of a PE based on the SEP approach due to the application of a tax treaty with another jurisdiction a foreign trader foreign service provider andor offshore PPMSE that meets the SEP condition is subject to electronic transaction tax.

Indonesia electronic transaction tax rate. Non-resident individuals are subject to a general withholding tax WHT at 20 in respect of their Indonesian-sourced income. If the seller is non-Indonesian tax resident a 5 capital gains. It is important to know that if there is a profit or capital gain generated from a transaction the profit is an object of income tax the official stated.

And 17 starting fiscal year 2022. PMSE or e-commerce tax treatments. Qualifying listed Indonesian companies 2 are entitled to receive an additional three percentage point reduction CIT rate of 19 for tax years 2021 and 2022 and 17 for tax years 2023 onwards.

The settlement and reporting of the tax due is done on self-assessed basis. The narrow timeframe for affected businesses to comply will no doubt be challenging. Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals.

Additionally individual taxpayers who are earning at least 48 billion. This is governed by Law 30 of 2008 and would mean that online businesses classified as small or medium enterprises SMEs must pay 05 percent in income tax while large companies pay the 25 percent corporate tax rate. Noor said that.

Online sellers must now adhere to prevalent regulations regarding income tax. 48PMK032020 Reg 482020 in May 2020 which imposes a 10 percent value-added tax VAT on digital services on non-resident companies starting July 1 2020. Tax treatment of e-commerce transactions Regulation No.

Relief related to Article 25 income tax provides that the corporate income tax rate will be reduced from 25 to 22 for financial years 2020 and 2021 and 20 for financial year 2022 onwards with an additional 3 reduction applicable for listed company with more than 40 public shares. Overseas sellers and e-commerce platform providers are required to appoint a representative in Indonesia to be responsible for paying and reporting the taxes related to these transactions. Pursuant to Law 2 and the implementing regulations Electronic System Transaction EST can attract.

1 for 2020 PERPPU-1 also addresses the tax treatment of activities conducted as e-commerce transactions. This VAT shall be collected and deposited by either i the foreign merchantsforeign e-commerce service providers who. Newly listed Indonesian companies will receive an additional three percentage point reduction CIT rate of 19 for tax years 2021 and 2022 and 17 for tax years 2023 and thereafter for a period of five years.

Indonesias online shopping industry is forecast to expand at an impressive compound annual growth rate of 346 percent to 2021 17 driven by increasing internet penetration which currently sits at a lowly 323 percent 18 and an ongoing trend of steady gross domestic product growth. The corporate income tax CIT rate will be reduced in phases from 25 to 22 for tax years 2021 and 2022 with a further reduction to 20 for tax years 2023 and thereafter. A VAT in the utilization of intangible taxable goods andor taxable services from outside of Indonesia in Indonesia through the EST.

For publicly listed companies with a minimum of 40 of shares held by public investors the corporate tax rate is further reduced by 3 with further conditions to be issued. After the five years the. The VAT rate is 10 of the purchase price.

Indonesias Ministry of Finance issued Regulation No. The CIT rate will be reduced in phases from 25 to 22 for tax years 2021 and 2022 with a further reduction to 20 for tax years 2023 and thereafter. Indonesian Tax Guide 2019-2020 3 Contents About Deloitte 4 General Indonesian Tax Provisions 7 Corporate Income Tax 14 Individual Income Tax 29 Withholding Tax and Final Tax 33 Value Added Tax 45 Transfer Pricing 55 Summary of Double Tax Avoidance Agreements 68 Tax Treaties Automatic Exchange of Information AEOI 78 List of Abbreviations 81 Contacts 82.

Neilmaldrin Noor a spokesperson for the Indonesian Directorate General of Taxes said that the authority is considering a tax scheme for capital gains generated from cryptocurrency trades Reuters reports Tuesday. Non-resident digital businesses with B2C sales to consumers based in Indonesia now have an obligation to register collect and remit 10 VAT on their sales there. The corporate tax rate is reduced to 22 for the 2020 and 2021 fiscal years with a further reduction to 20 from 2022.

4 About Deloitte Deloitte is a. 19 The scale of this development is clearly also a result of the industrys immaturity. Indonesian citizens that are living outside of Indonesia for more than 183 days in 12 months and meet certain requirements can also be considered as foreign tax subjects.

Why The Market Value Of Residential Premises And The Costs Of Its Purchase Differ The Examples Of Belarus And Poland Sciencedirect

Https Www2 Deloitte Com Content Dam Deloitte Pl Documents Reports Pl Deloitte Taxation And Investment 2021 Pdf

Pdf Taxation Of Digital Business Transactions Challenges And Prospects For Developing Economies

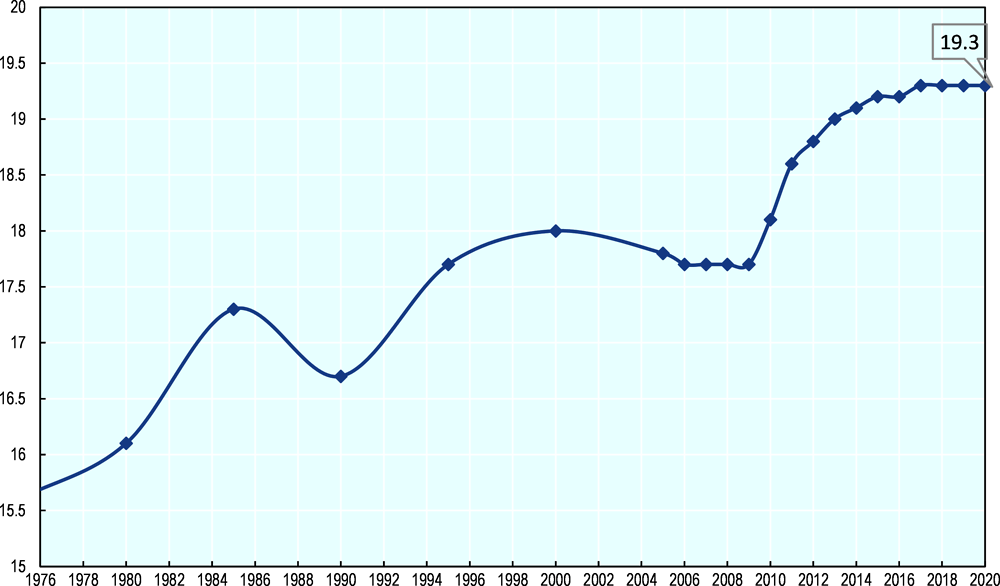

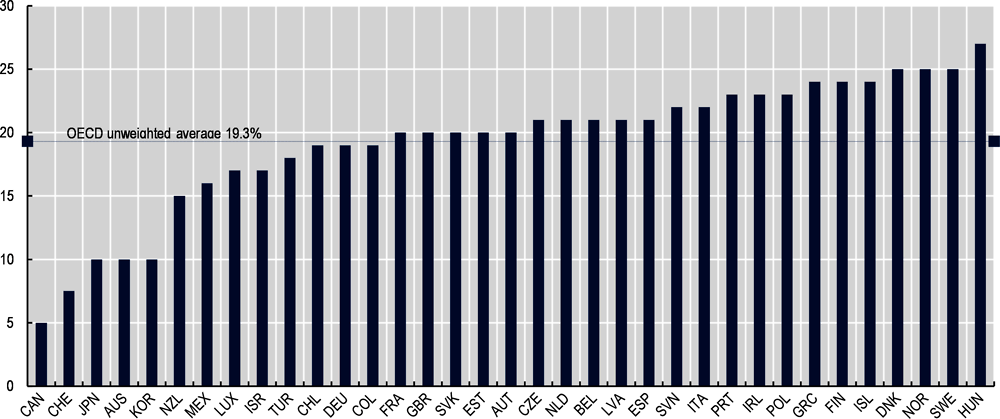

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Https Assets Ey Com Content Dam Ey Sites Ey Com En Gl Topics Tax Tax Guides Ey Worldwide Transfer Pricing Reference Guide 2018 19 Pdf

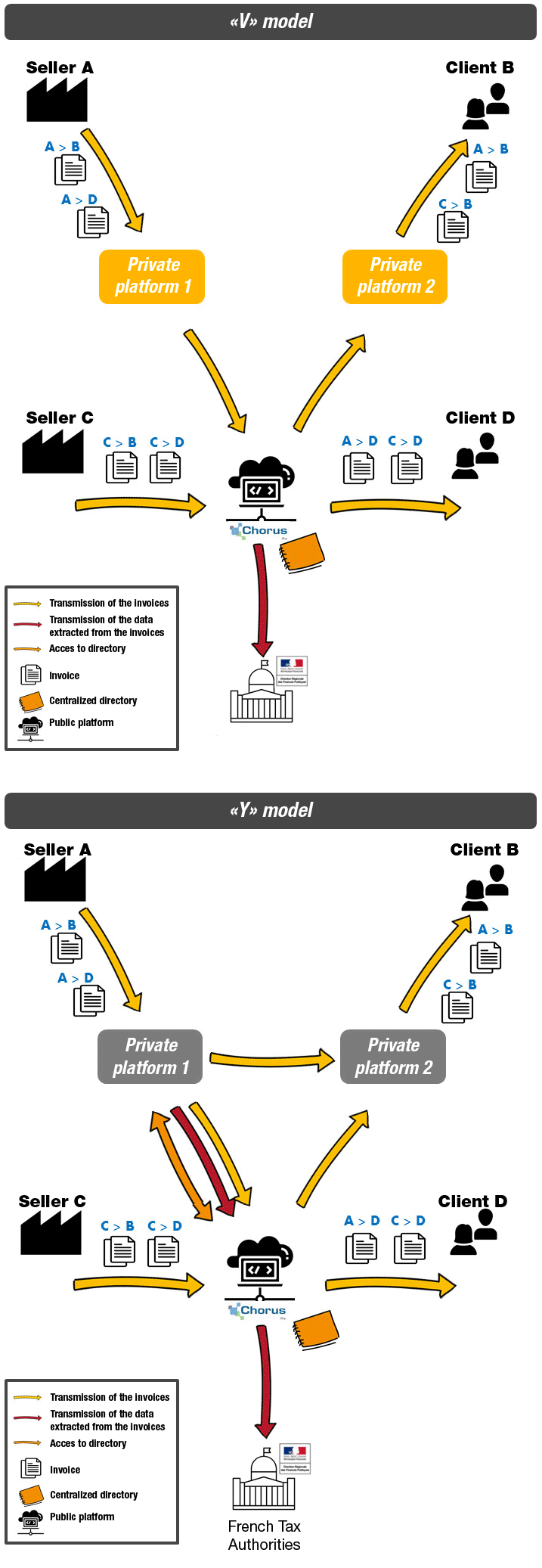

Reform 2023 2025 Or The Generalisation Of E Invoicing In France The Outlines Of The Dgfip Report

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Shopee S Transaction Fee Shopee My Seller Education Hub

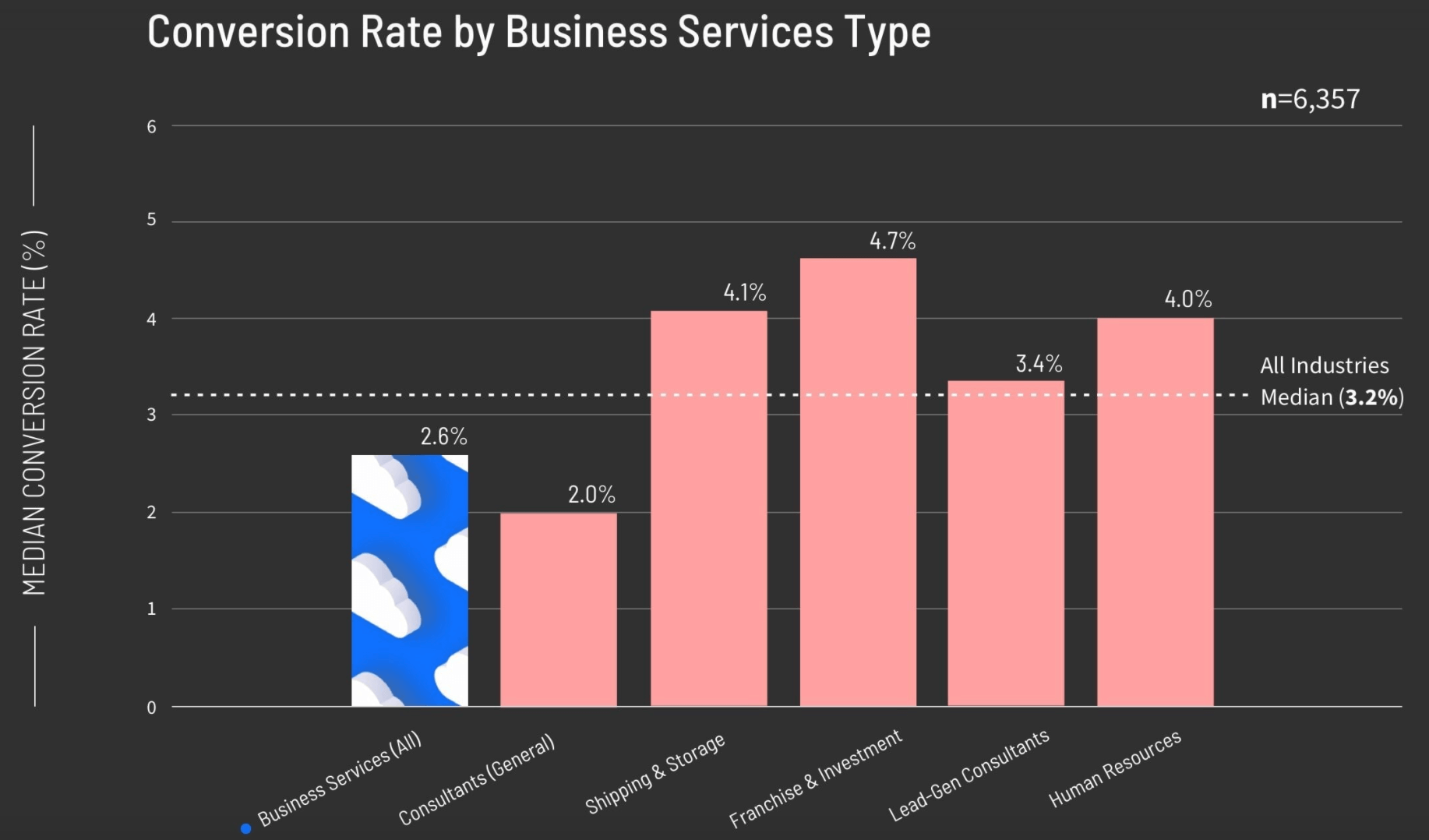

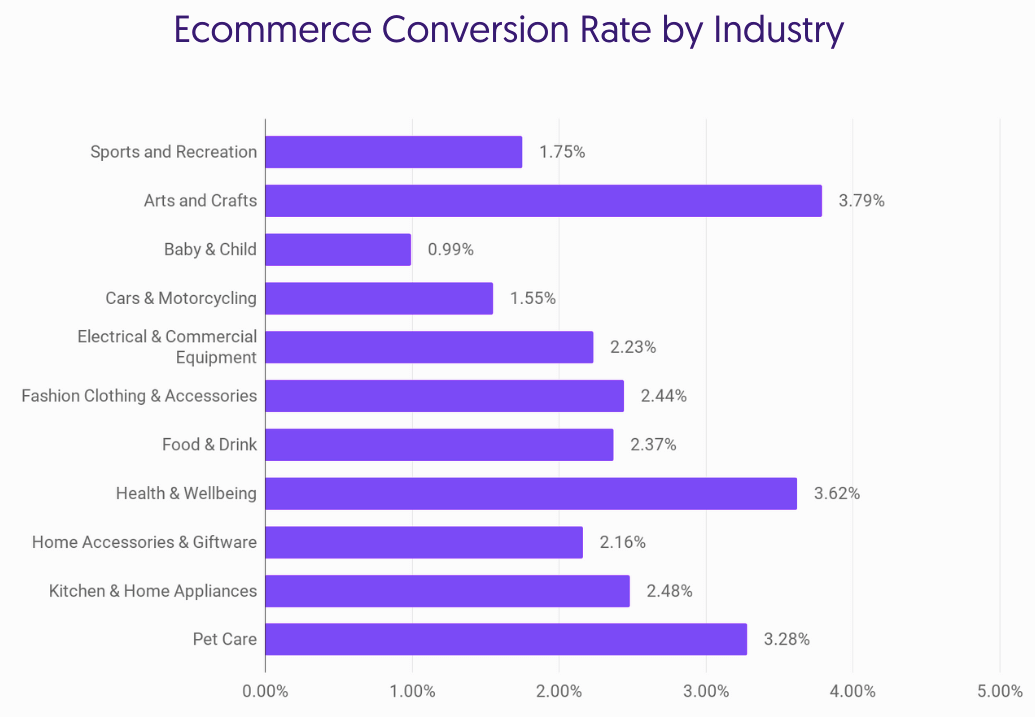

E Commerce Conversion Rates 2021 Compilation How Do Yours Compare

Https Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Tad Ca Apm Wp 2018 30 20final Doclanguage En

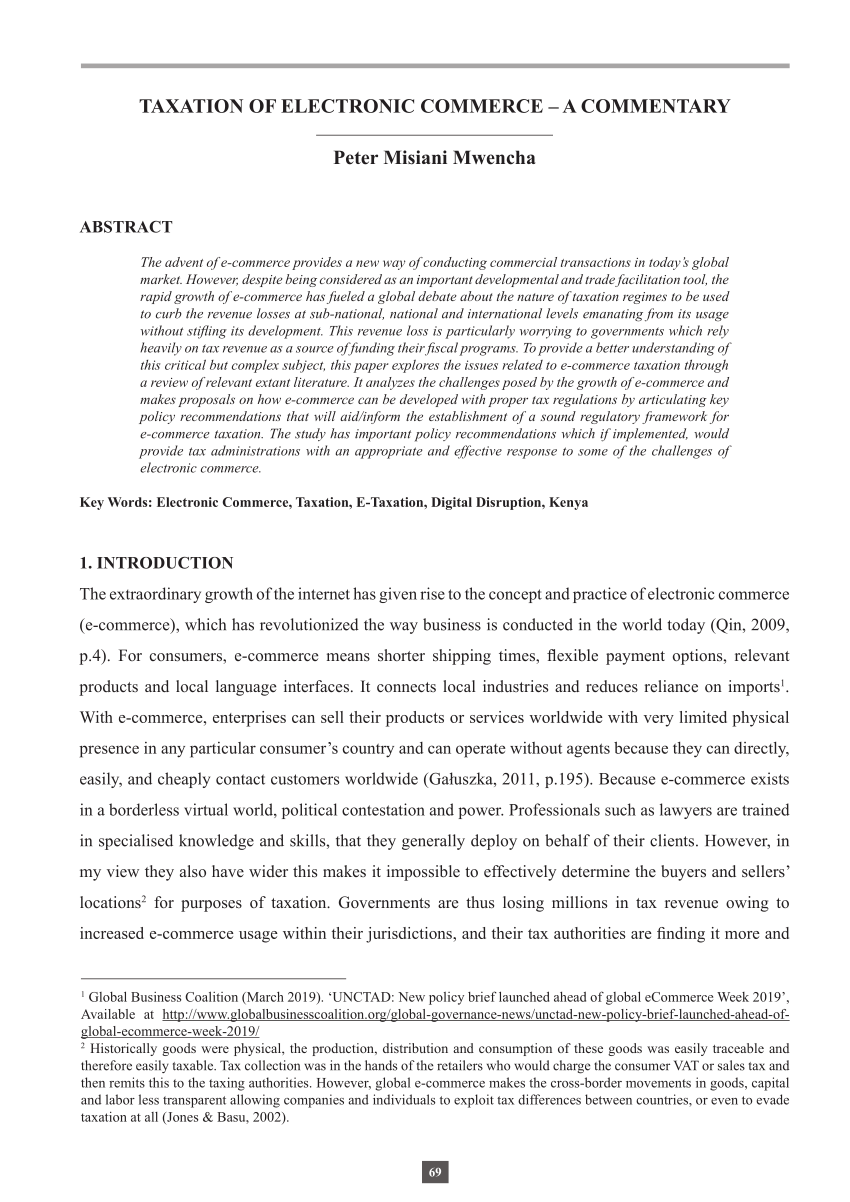

Pdf Taxation Of Electronic Commerce A Commentary

Taxation Of Digital Transaction Equalisation Levy

E Commerce Conversion Rates 2021 Compilation How Do Yours Compare

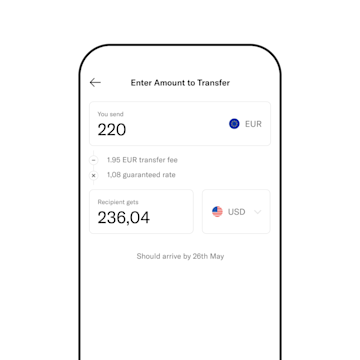

N26 Foreign Currency Transfers Go Further With Wise N26

Intra Gcc Transactions Under Gcc Vat Law Exceldatapro Law Goods And Services Gaming Logos

Critique La Carte Visa Prepayee Ruby Steel De Crypto Com Prepaid Visa Card Visa Card Cards

Https Www Twobirds Com Media Pdfs Bird Bird Digital Services Tax Overview Pdf

Post a Comment for "Indonesia Electronic Transaction Tax Rate"